Annalaine Events: Celebrating Life's Moments

Your go-to blog for event planning inspiration and tips.

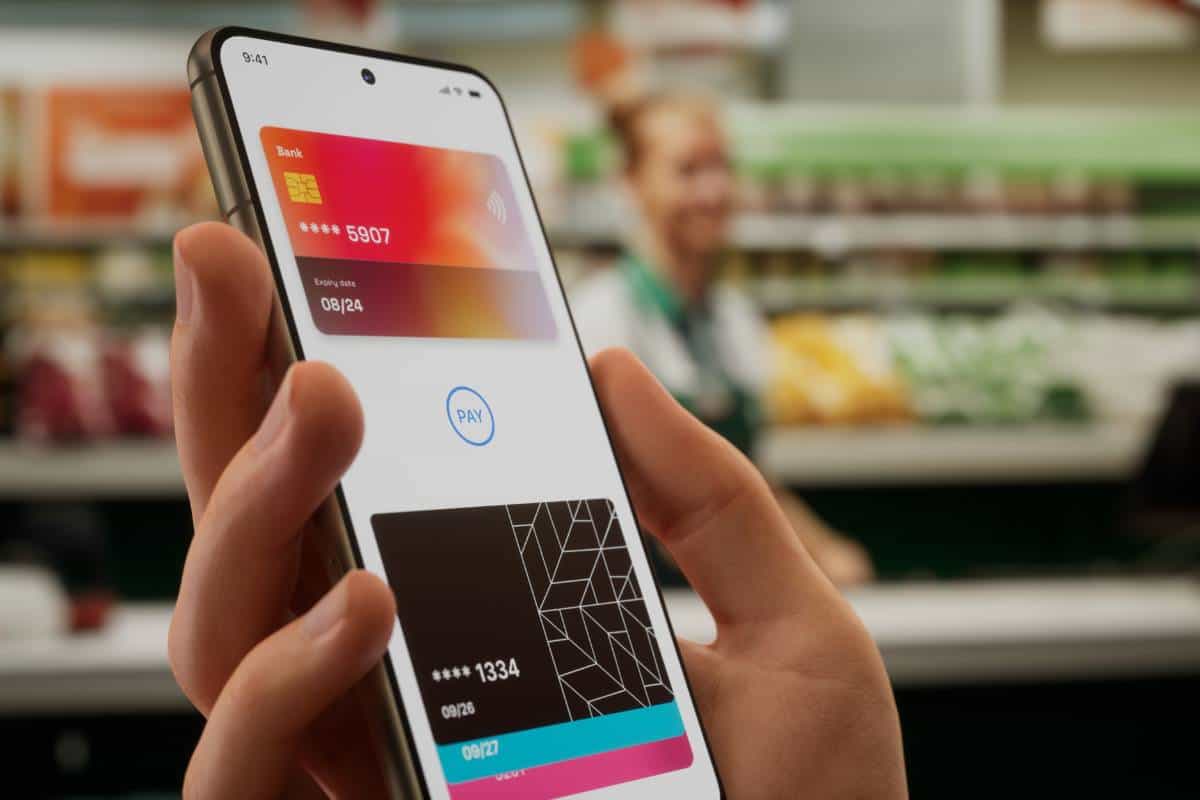

Digital Wallet Integrations: Making Payment Processing a Breeze

Unlock seamless transactions with digital wallet integrations! Discover how to simplify payment processing and boost your business today!

Understanding Digital Wallet Integrations: How They Simplify Payment Processing

In today's fast-paced digital economy, businesses are constantly seeking ways to enhance customer experience and streamline operations. One of the most significant advancements in this arena is the integration of digital wallets, which facilitates a more efficient and secure payment processing method. By allowing customers to store their payment information in a virtual format, digital wallets eliminate the need for traditional credit cards or cash. This not only speeds up transactions but also reduces the likelihood of human error and fraud. Companies that embrace these technologies can see a notable improvement in customer satisfaction, leading to increased loyalty and sales.

Moreover, digital wallet integrations provide businesses with a comprehensive overview of their financial transactions, enabling them to make informed decisions. With features like real-time analytics and reporting, companies can track their sales performance and customer behavior effectively. Additionally, these integrations often support multiple currencies and payment methods, making them an ideal solution for businesses that operate on a global scale. By simplifying the payment processing experience for both customers and merchants, digital wallets are revolutionizing the way we conduct transactions in the digital age.

Counter-Strike is a highly popular first-person shooter game that emphasizes team strategy and tactical gameplay. Players can engage in various game modes, and the competitive scene is robust, with tournaments held worldwide. If you're interested in enhancing your gaming experience, you might want to check out the betpanda promo code for some exciting offers.

Top 5 Benefits of Integrating Digital Wallets into Your Business

Integrating digital wallets into your business can significantly enhance customer convenience. With the ability to make contactless payments through mobile apps, customers can complete transactions in a matter of seconds, eliminating the long lines and wait times associated with traditional payment methods. This not only improves customer satisfaction but also encourages repeat business. Additionally, as digital wallets continue to gain popularity, offering this payment method can give your company a competitive edge in the market.

Another major advantage of adopting digital wallets is the enhanced security they provide. Unlike conventional credit or debit cards, digital wallets do not store sensitive information on the device itself, reducing the risk of fraud. Payments made through these wallets utilize encryption and tokenization, keeping your customers' financial details safe. This level of security can lead to increased trust in your business and encourage more consumers to choose you over competitors who do not offer such secure payment options.

What You Need to Know About Security in Digital Wallet Payment Processing

As digital wallet payment processing becomes increasingly popular, understanding the security measures in place is crucial for both consumers and businesses. Digital wallets store sensitive information such as credit card details and personal data, making them a prime target for cybercriminals. To protect this information, leading digital wallet services implement advanced encryption technologies and two-factor authentication (2FA). These practices ensure that even if a hacker intercepts the data, it remains unusable without the proper decoding methods.

Additionally, it is vital to stay informed about the security features offered by various digital wallets. When choosing a wallet, users should look for features like transaction monitoring, fingerprint recognition, and biometric access controls. According to recent studies, approximately 60% of users express concerns over security when using digital wallets. Ensuring a wallet has strong security features can significantly reduce the risk of fraud, giving users peace of mind while they enjoy the convenience of digital transactions.