Annalaine Events: Celebrating Life's Moments

Your go-to blog for event planning inspiration and tips.

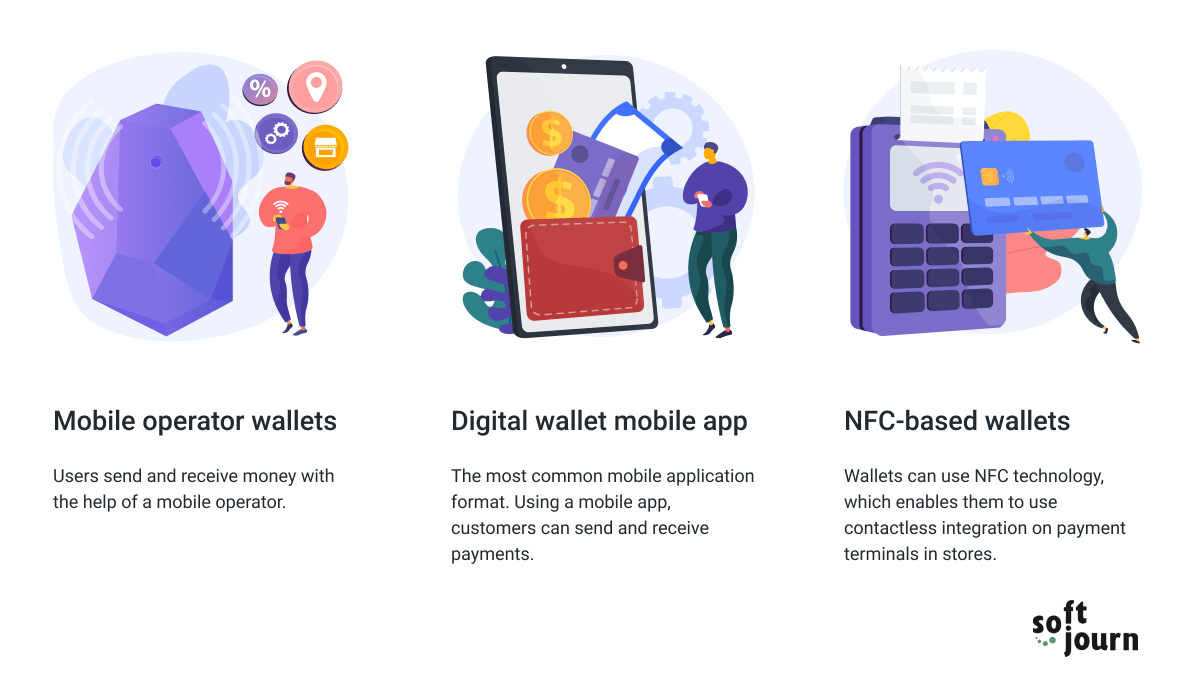

Digital Wallet Integrations: Where Convenience Meets Innovation

Unlock the future of payments! Discover how digital wallet integrations are revolutionizing convenience and innovation for consumers and businesses.

Understanding Digital Wallet Integrations: Benefits and Best Practices

Digital wallet integrations are transforming the way businesses handle payments and customer transactions. By allowing users to store their credit card information, loyalty cards, and even cryptocurrencies in one secure location, businesses can significantly enhance the customer experience. The benefits of adopting these technologies include faster transactions, improved security measures, and higher customer satisfaction. Moreover, integrating digital wallets can streamline the checkout process, reducing cart abandonment rates. With an increasing number of consumers preferring contactless payments, it's essential for businesses to adapt and embrace these new payment methods.

To ensure successful digital wallet integrations, it is crucial to follow some best practices. Firstly, businesses should choose the right payment gateway that supports multiple digital wallets to cater to diverse customer preferences. Secondly, it is essential to maintain a user-friendly interface during the payment process, which includes clear instructions and minimal steps. Additionally, incorporating robust security features, such as encryption and two-factor authentication, can help build trust with customers. Lastly, staying updated with the latest trends in digital payment technologies will enable businesses to continuously optimize their integration strategies and offer the best possible experience to their users.

Counter-Strike is a popular multiplayer first-person shooter that emphasizes teamwork and strategy. Players can engage in intense matches while utilizing various weapons and tactics. For those interested in enhancing their gaming experience, using a betpanda promo code can provide exciting bonuses and promotions.

Five Key Features to Look for in Digital Wallet Solutions

In the rapidly evolving landscape of digital transactions, selecting the right digital wallet solution is crucial for both businesses and consumers. When evaluating various options, consider the security features offered by each provider. This includes advanced encryption technologies, two-factor authentication, and features that protect sensitive user information. Ensuring that your digital wallet solution prioritizes user security can help foster trust and encourage more frequent usage.

Another essential feature to examine is user-friendliness. A digital wallet should offer a seamless and intuitive interface to ensure users can navigate and complete transactions without hassle. Look for solutions that support a wide range of payment options, including credit cards, debit cards, and even cryptocurrencies. Additionally, consider the compatibility with other financial applications, as this can enhance the overall user experience and efficiency of managing finances.

How Digital Wallets are Revolutionizing Online Payments: A Comprehensive Guide

The emergence of digital wallets has dramatically transformed the landscape of online payments, making transactions faster, safer, and more convenient than ever before. With the integration of advanced technology such as encryption and biometric authentication, digital wallets provide users with a seamless experience while ensuring that sensitive financial information is protected. The rise of mobile commerce and the increasing reliance on smartphones have further propelled the adoption of these electronic payment solutions, enabling consumers to make transactions at their fingertips, whether they are shopping online or transferring money to friends.

In addition to enhancing user experience, digital wallets also offer businesses a host of benefits that contribute to increased sales and customer loyalty. By providing various payment options, including credit and debit cards, bank transfers, and even cryptocurrency, merchants can cater to a wider audience. Furthermore, the ability to send targeted promotions and rewards through digital wallets allows businesses to engage with customers on a personalized level, thereby boosting retention rates. As digital wallets continue to evolve, it is clear that they are not only changing the way we pay but are also setting the stage for the future of commerce.