Annalaine Events: Celebrating Life's Moments

Your go-to blog for event planning inspiration and tips.

Offshore Banks: Your Secret Vault Under the Waves

Discover the hidden world of offshore banks and unlock financial freedom with our guide to your secret vault under the waves!

Top 5 Reasons to Consider Offshore Banking for Your Wealth

Offshore banking has become an increasingly popular choice for individuals looking to enhance their wealth management strategies. One of the primary reasons to consider this financial option is privacy. Many offshore banks offer a high degree of confidentiality, protecting your financial information from unwanted scrutiny. This is particularly appealing for high net worth individuals who wish to keep their finances away from prying eyes. Additionally, offshore accounts often provide access to international investment opportunities, enabling clients to diversify their portfolios beyond the limitations of their home country.

Another significant reason to explore offshore banking is the potential for tax benefits. Some jurisdictions provide favorable tax regimes for foreign investors, allowing individuals to legally minimize their tax liabilities. Moreover, offshore banks often have fewer regulations than domestic ones, which can translate into higher returns on investments. Lastly, the stability offered by offshore banks in politically and economically stable countries provides a safeguard against domestic financial crises, ensuring that your wealth is protected even in turbulent times.

How Offshore Banks Provide Security and Privacy for Your Assets

Offshore banks offer a unique blend of security and privacy for individuals seeking to protect their assets from economic instability and political turmoil. By setting up accounts in jurisdictions with strict confidentiality laws, clients can enjoy a heightened level of financial privacy. These banks typically employ advanced security measures, including encrypted transactions and multi-layer authentication, ensuring that your assets are not only secured against fraud but also shielded from unwanted attention. As world events can create unpredictable economic climates, offshore banking serves as a strategic safeguard against potential crises.

Furthermore, the privacy afforded by offshore banks allows account holders to manage their wealth with discretion. Many individuals are concerned about increasing regulations and the potential for government scrutiny on their finances. Offshore banking addresses this concern by enabling clients to conduct their financial affairs free from invasive reporting requirements. This level of confidentiality can be particularly advantageous for those with significant assets, as it minimizes the risk of invasion of privacy by government authorities or unsolicited inquiries. Ultimately, the combination of security and privacy makes offshore banks an appealing option for safeguarding one’s wealth.

What You Need to Know Before Opening an Offshore Bank Account

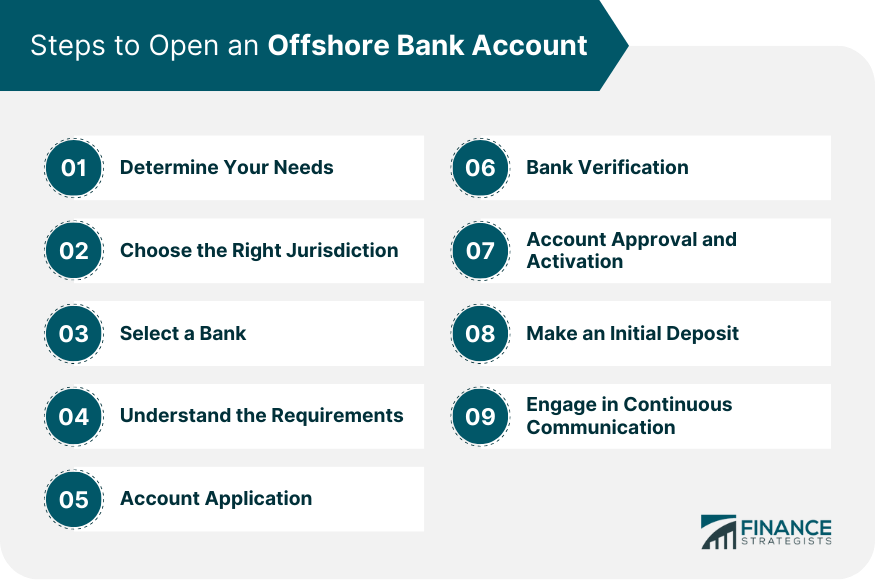

Before opening an offshore bank account, it's crucial to understand the benefits and risks associated with it. Offshore accounts can provide enhanced privacy, asset protection, and potential tax advantages. However, they can also attract scrutiny from tax authorities and may require compliance with complex regulations. Therefore, it is essential to conduct thorough research and consult with a financial advisor who specializes in international banking.

Another vital aspect to consider is the selection of the right jurisdiction. Different countries offer varying levels of banking privacy, fees, and regulations. Some of the most popular offshore banking locations include Switzerland, the Cayman Islands, and Singapore. When choosing a jurisdiction, consider factors such as political stability, banking reputation, and the services provided by the bank. It's also wise to review the bank's fees and account requirements to avoid unexpected costs.